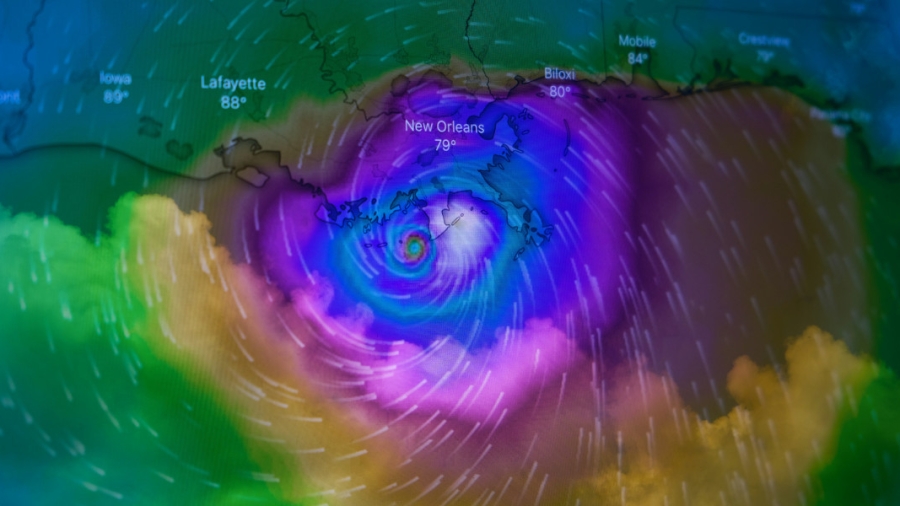

In July, the ports of Houston and New Orleans saw slight declines in container movements due to disruptions caused by Hurricane Beryl and global supply chain challenges. However, crude oil shipments at the Port of Corpus Christi saw a significant boost during the same period.

Port Houston Faces Setbacks Due to Hurricane Beryl and IT Disruption

Port Houston’s container volume dropped by 5% year-over-year in July, handling 325,277 twenty-foot equivalent units (TEUs), largely due to the impact of Hurricane Beryl and a global IT outage. The port was forced to close on July 8-9 after Hurricane Beryl made landfall in Texas as a Category 1 hurricane. A second disruption occurred on July 19 when a faulty software update from CrowdStrike briefly shut down internet services, leading to the closure of Barbours Cut and Bayport Container terminals.

“Locally we faced some challenges this month, but our team excelled at rebounding quickly and maintaining the customer service Port Houston is known for,” said Roger Guenther, Port Houston’s executive director.

Despite these setbacks, Port Houston’s overall tonnage increased 3% year-to-date, reaching a total of 31 million tons. The port saw growth in specific cargo types, including imports of plywood, wind power equipment, and wood/fiberboard. However, steel imports dropped 14% year-over-year to 367,915 tons, while steel exports plummeted by 40% to 18,955 tons.

Interestingly, empty import container movements rose by 17% in July, signaling global carriers’ efforts to reposition containers for future cargo. In contrast, loaded imports and exports both declined by 5% and 4%, respectively.

Port Houston’s barge activity increased by 16% with 334 barge calls, while ship calls dipped slightly, down 4% year-over-year.

Port of New Orleans Sees Decline in Container Volumes

At the Port of New Orleans, container shipments dropped sharply by 19% year-over-year in July, with a total of 36,266 TEUs handled. Total breakbulk tonnage also fell by 7%, with the port managing 67,837 short tons during the month.

Port spokeswoman Kimberly Curth cited several global supply chain disruptions that contributed to these declines, including congestion at ports in South America and Asia, continued disruptions in the Suez Canal, and Hurricane Beryl’s impact on operations in the Caribbean and Gulf of Mexico.

Despite these challenges, the port continued to handle imports of key products such as wood, rubber, chemicals, and coffee, while exports included plastic resins, paper products, and chemicals. Steel remained the top breakbulk cargo for the port.

On a positive note, the Port of New Orleans saw a significant 21% year-over-year increase in Class I rail car switches, handling 10,846 rail cars for six major railroads including BNSF, CN, and Union Pacific.

Crude Oil Shipments Surge at Port of Corpus Christi

While other ports saw declines, the Port of Corpus Christi recorded a 13% year-over-year increase in crude oil shipments for July, handling a total of 11.56 million tons. Crude oil exports were up by 13%, totaling 10.8 million tons, while imports rose by 8% year-over-year to 681,049 tons.

However, not all cargo types saw growth. Petroleum shipments decreased by 3.7% year-over-year, and dry bulk cargo volumes dropped by 21%. Conversely, chemical bulk shipments experienced a 3.2% increase, while bulk grain shipments fell by 8.5%.

The port also saw a 21% decrease in barge calls year-over-year, handling 402 in July, while ship calls remained stable with a slight increase from 197 to 206.

Conclusion

July proved to be a challenging month for several of the Gulf’s major ports. Hurricane Beryl and global supply chain disruptions caused dips in container volumes at both Port Houston and the Port of New Orleans. However, the resilience of these ports and their ability to quickly rebound ensured that operations continued. Meanwhile, the Port of Corpus Christi saw a surge in crude oil shipments, highlighting the port’s crucial role in energy exports. As global supply chains continue to face disruptions, maintaining operational flexibility will be key for ports in the coming months.